Dublin Industrial Market Q3 2019:

There were 25 deals in Q3 with a total of 42,000 sq m transacting, less than half the quantum achieved during the same period last year. However, based on the first nine months of the year, take-up is 17% higher at 240,000 sq m.

Lettings accounted for 70% of activity in Q3 with sales comprising the remaining 30%.

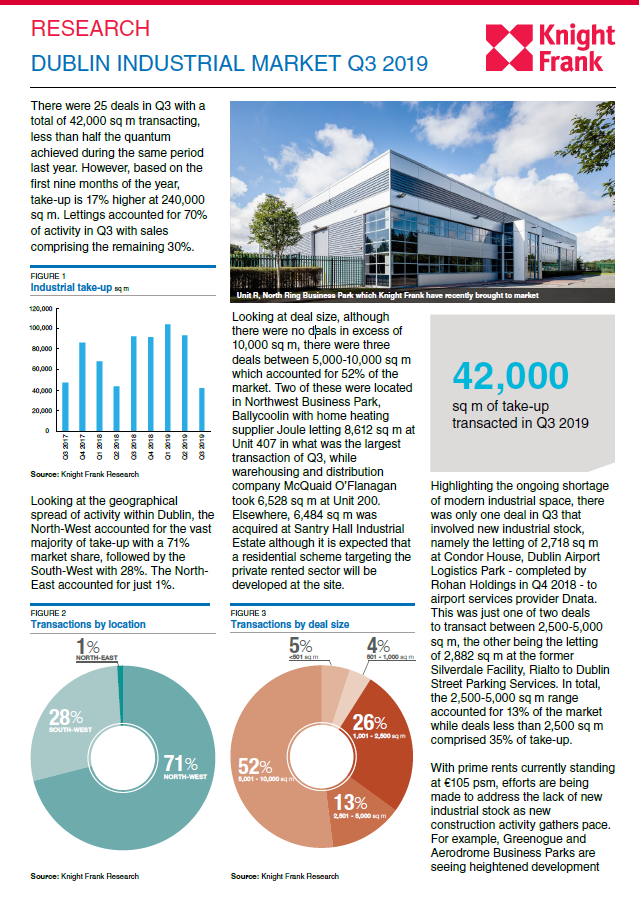

Looking at the geographical spread of activity within Dublin, the North-West accounted for the vast majority of take-up with a 71% market share, followed by the South-West with 28%. The NorthEast accounted for just 1%.

Deal Sizes:

Looking at deal size, although there were no deals in excess of 10,000 sq m, there were three deals between 5,000-10,000 sq m which accounted for 52% of the market. Two of these were located in Northwest Business Park, Ballycoolin with home heating supplier Joule letting 8,612 sq m at Unit 407 in what was the largest transaction of Q3, while warehousing and distribution company McQuaid O’Flanagan took 6,528 sq m at Unit 200. Elsewhere, 6,484 sq m was acquired at Santry Hall Industrial Estate although it is expected that a residential scheme targeting the private rented sector will be developed at the site.

Highlighting the ongoing shortage of modern industrial space, there was only one deal in Q3 that involved new industrial stock, namely the letting of 2,718 sq m at Condor House, Dublin Airport Logistics Park – completed by Rohan Holdings in Q4 2018 – to airport services provider Dnata. This was just one of two deals to transact between 2,500-5,000 sq m, the other being the letting of 2,882 sq m at the former Silverdale Facility, Rialto to Dublin Street Parking Services. In total, the 2,500-5,000 sq m range accounted for 13% of the market while deals less than 2,500 sq m comprised 35% of take-up.

With prime rents currently standing at €105 psm, efforts are being made to address the lack of new industrial stock as new construction activity gathers pace.