Dublin Industrial Market Q1 2019:

104,387 sq m of industrial space transacted in Q1 across 36 deals, representing a 54% increase compared to the same quarter last year. Lettings accounted for 63% of activity with sales accounting for the remaining 37%.

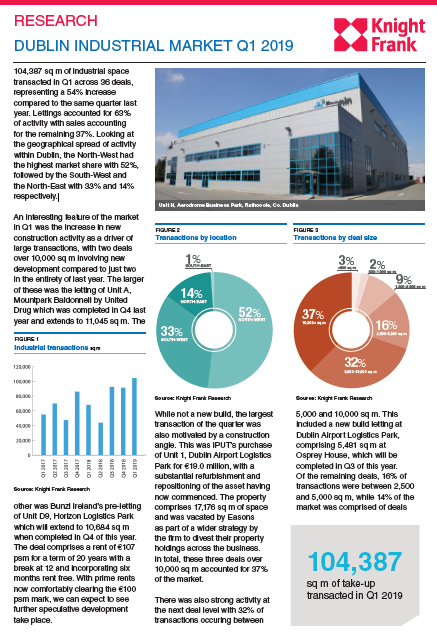

Looking at the geographical spread of activity within Dublin, the North-West had the highest market share with 52%, followed by the South-West and the North-East with 33% and 14% respectively.

An interesting feature of the market in Dublin Industrial Market Q1 2019 was the increase in new construction activity as a driver of large transactions, with two deals over 10,000 sq m involving new development compared to just two in the entirety of last year. The larger of these was the letting of Unit A, Mountpark Baldonnell by United Drug which was completed in Q4 last year and extends to 11,045 sq m.

The other was Bunzl Ireland’s pre-letting of Unit D9, Horizon Logistics Park which will extend to 10,684 sq.m when completed in Q4 of this year. The deal comprises a rent of €107 psm for a term of 20 years with a break at 12 and incorporating six months rent free. With prime rents now comfortably clearing the €100 psm mark, we can expect to see further speculative development

take place.

Largest Transaction of the Quarter

While not a new build, the largest transaction of the quarter was also motivated by a construction angle. This was IPUT’s purchase of Unit 1, Dublin Airport Logistics Park for €19.0 million, with a substantial refurbishment and repositioning of the asset having now commenced. The property comprises 17,176 sq m of space and was vacated by Easons as part of a wider strategy by the firm to divest their property

holdings across the business. In total, these three deals over 10,000 sq.m accounted for 37% of the market.